October 6, 2021

An IPL perspective – Surviving The Supply Chain ‘Storm’

Enormous pressures on the worldwide supply chain have done little to ease over the past few weeks. Frustratingly, more than 18 months into the Covid-19 pandemic, the vast global network of ports, container vessels and trucking companies transporting goods around the world remains agonisingly stretched.

A Sea Change

The unprecedented global supply-chain disruption is spurring severe shortages in consumer products and forcing companies to contend with heavily increased shipping costs, all as brands push towards a decidedly critical year-end shopping season.

“The system has been unable to withstand the shocks it has been plagued by: the major port closures (due to Covid outbreaks) in China, labour shortages hampering destination maneuvers and customs processes, container misplacement, weather disruptions such as hurricanes, and now, insufficient vessel capacity due to high seasonal demand,” says Faizal Kassim, Director of Operations for global packaging supplier, IPL Packaging.

“Whilst Chinese manufacturers are pumping out record volumes of freight containers after shippers ordered vast stacks of the steel boxes in an attempt to smooth out disruptions in the global supply chain, shipping executives are warning it will do little to ease the global ocean freight and supply problems,” he explains.

“Supply chain strategies have undergone a sea change from ‘just-in-time,’ with an emphasis on inventory reduction, to building more resilient supply chains better geared to withstand shocks,” says Kassim. “Though of course there are financial implications to stockpiling that are adding to the pressure of increased freight charges.”

Could the fragile system be upset further?

“Whilst the remarkable speed with which vaccines have been brought to market should help bring the pandemic and it’s ramifications under control, the risks are still on the rise. Across the globe, vaccination uptake will continue to impact how the system absorbs any further shocks.”

“Factors such as future Covid and Covid variant outbreaks, and to what extent China and other major port nations are required to impose tough regulations to protect their populations, remains another critical factor,” he states.

“Major weather events are also growing in severity and frequency and the longer-term challenges of climate change will require a dynamic, end-to-end approach to managing supply chain risk,” says Kassim.

“Added to this, Covid lockdowns have caused mismatches in supply and demand that will take time to find equilibrium. This because, with so many people working from home, consumers who traditionally spent their disposable income on services such as leisure, entertainment and tourism are now spending money on ‘hard goods’ and setting up their homes as secondary offices.”

Positive Perspectives

“Nevertheless, 2021 has been a force for change, and not all of that change has been negative,” he states. “The positives include enhanced due diligence, mapping processes and the forging of significantly closer relationships with clients and suppliers.“

“The past 18 months have also engendered higher degrees of collaboration,” states Kassim. “Before Covid-19, dealings with logistics providers were of a predominantly transactional nature, but this has completely changed. Pricing has been relegated to just one aspect of the undertaking, with the emphasis now on developing solutions.”

“The situation has called for improved planning, increased communication and greater transparency with logistics partners,” explains Kassim. “We’re now strongly focused on shipping efficiency. We’re leveraging off our decades-long relationships with logistics partners and ensuring we keep our agents in the loop. This allows us to make preparations for the next vessel into China and ensure adequate space is secured.”

“With supply chain issues affecting many a brand’s balance sheet, senior management is now typically more engaged with these issues than ever before,” notes Kassim. “This elevated level of interest can – and should – remain,” he stresses. “Supply chain strategies will need a sea change from “just-in-time” (with an emphasis on cost reduction), to forging more resilient supply chains geared to withstand shocks but balance inventory costs.”

Diversifying Supply

“Forging and building on our relationships with local European production partners and partners ‘closer to home’ now seems ever critical,” says Christiana Delahaye, IPL’s Senior Purchasing Manager for Europe. “Now more than ever, a dynamic supply chain can ensure clients are better positioned to deal with future global disruptions.”

“At IPL we’ve a number of partner factories in Eastern Europe with small productions already underway,” she says. “Eastern European suppliers are seeing the opportunity presented by the current global situation and are certainly gearing up. Most are unable to absorb the large production volumes required at this point in time, but are motivated to do so for the future.”

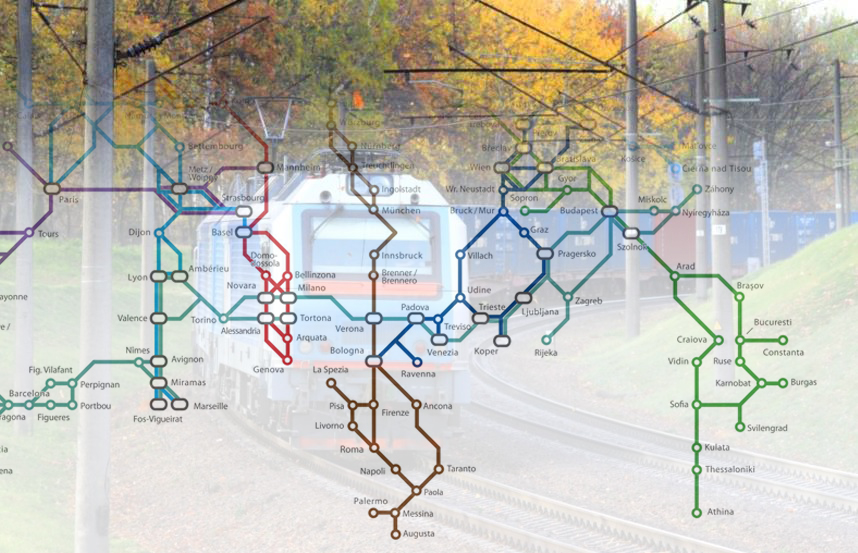

“Railage is certain to be a growing trend. The European network is fairly sound but will need to be better maintained and renewed for increased capacity, especially in Eastern Europe,” she explains. “Currently, there are delay issues between the UK and the EU due to Brexit and the implementation of new customs regulations. We trust forwarders in Eastern Europe will work hard to adjust the situation in the future.”

“We expect shipping rates to remain high until February 2022, and then anticipate a significant drop in rates, but not to the historic lows they have been over the previous five years,” says Kassim. “At IPL we remain encouraged by the various governments’ scrutiny of these increased freight rates, both in Europe and the USA as well as China.”

“We’re also guaranteed to see a diversification of supply bases amongst many producers, though not a mass migration from one to another. It is prudent not to engage in knee-jerk reactions, especially as the situation is bound to rectify itself over time,” says Kassim. “We’ve all learnt significant lessons over the past few months. We just have to ensure the lessons learnt are not forgotten.”

IPL Packaging is a global luxury packaging supplier with offices in the USA, Europe, Mexico, Asia and Africa. Approved manufacturing is available in several Asian countries, as well as sites in Eastern Europe. We create bespoke, tailored and exclusive packaging for any premium or luxury brand and lead the entire process, from conceptualisation and design to production and delivery.

For more information on packaging solutions or to gain insight into our latest packaging trends, follow us on LinkedIn, Facebook, YouTube or Pinterest. Keep an eye on our news section for insightful articles and innovative ideas around packaging materials, product development and design.

More articles

October 25, 2022

Navigating ‘Critical to Quality’ Packaging Hurdles

July 26, 2022

6 Strategic Priorities for Packaging Companies in the New Unknown

August 25, 2022

The Supply Chain: Guidelines for Ramping up Resilience

June 23, 2021

4 Important considerations for cosmetics packaging

February 25, 2021

Crystal Gazing: the box that heroes the jewellery

August 23, 2022

Scents of Sustainability

April 18, 2024

Luxury Regulated

February 11, 2021