January 26, 2022

7 Trends Shaping a New Future for the Packaging Industry in 2022

The packaging industry has proven to be largely robust and resilient through the Covid-19 pandemic, but changes are inevitable. As we find ourselves on the cusp of this post pandemic world, how have things shifted from both a positive and negative perspective – and how many of these shifting trends and changes will remain permanent?

1. Unstoppable e-Commerce

Will in-person retail continue to transition to online sales and what does this mean for packaging?

“The pandemic has seen demand for e-commerce skyrocket,” says Glen Broomberg, IPL’s Head of Global Business Development. “This will remain the case even as the pandemic subsides, as in-store shopping rebounds and as a larger share of consumer spending returns to those services such as travel and live entertainment.”

“In many cases, e-commerce has simply become the ultimate in convenience and increasing numbers of consumers have become comfortable buying online,” he says. “Whilst brick-and-mortar stores will certainly gain more foot traffic as we emerge from the pandemic, the omni-channel approach will continue to thrive.”

“The online retail focus is now on getting products safely to consumers first time – and so the importance of packaging that offers the protection of goods through robust applications has never been more crucial,” says Broomberg. “Retailers want to minimise the risk of product loss or damage through delivery and to reduce the potential of financial losses and returns. This emphasis will continue for the foreseeable future. Of course, the unboxing experience also remains an important consideration for online product exposure.”

“With less market share than before, brick and mortar retailers will seek to distinguish themselves from the online experience. We foresee increased pressure on traditional retailers to justify and enhance the shopping experience. Some of the onus may lie in packaging differentiation. Brands will need to fight harder in-store to win shelf space from retailers, spaces where packaging needs to appeal not only to the eye but also to the touch.”

2. The Sustainability Super-Surge

Are we more aware of our fragile planet than ever – or will there be less emphasis on sustainable solutions?

“The answer seems obvious and in truth packaging solutions constructed from recycled or biodegradable materials are now more in demand than ever,” says LB Odendaal, IPL’s Head of Design. “As such, more and more luxury brands will continue to look at how to further innovate to ensure their product packaging is as luxuriously differentiated as it is ecologically sustainable.”

“The pandemic-accelerated shift to e-commerce has also driven changes in packaging size, consumer perception of packaging and waste, and the demand for more return-friendly packaging. Shoppers are rediscovering the power of community and therefore are looking for companies that are in line with their values (like sustainable sourcing, organic, giving back, low-plastic, etc.),” he says.

© Delta Community

“Brands (in conjunction with packaging designers) will be required to continue to introduce well-targeted design tweaks, more sustainable material and fitment choices – and implement simple changes to help ‘design out’ waste and produce products that are circular,” states Odendaal. “This will help them build brand capital, fulfil customer demand and stay on the right side of current and future regulations aimed at minimising waste and environmental damage.”

“Consumer awareness of the impact of single-use packaging and the negative impact it has on our environment has led to rapid legislative changes in many countries where, in some instances, we now see single-use plastics being banned. A global awareness of the need for more sustainable packaging is driving not only material innovation, but also pushing designers to radically rethink the way we interact with and potentially reuse and rework packaging, incorporating secondary use into packaging items, creating more value through longevity.”

“The future will see less frivolous and unnecessarily wasteful use of materials, designs geared to single stream recycling, and the use of less environmentally harmful materials,” he states. “We are more invested in researching and developing new and innovative materials and processes to insure we produce sustainable packaging, offering a more engaging experience at less cost to the consumer and the environment.”

3. Expanding Innovation

How has the global slowdown impacted new product development and innovation?

“In many ways the slowdown of business has actually provided well-positioned, forward-looking brands and packaging suppliers with a unique opportunity to use time to maximise efficiencies, examine options for innovation, and emerge stronger than ever,“ says Christiana Delahaye, Senior Purchasing Manager, Europe for IPL. “That’s certainly one of the positives to come from these uncertain times.”

“Whilst many suffered during the slowdown, well-managed and resourced companies and suppliers used their slow times on equipment upgrades, new lines, plant improvements, testing of new products and packaging materials and introducing new innovations and improvements to make them more efficient as better days inevitably return,” explains Delahaye.

© Rockwell Automation

“This has been particularly noticeable in several Eastern European countries that have taken the infrastructure, trade and investment gap provided by the recent shipping crisis that strained competitive China,” she states. “At the end of 2021 our EE suppliers were very busy in all sectors; glass, rigid board, wooden boxes, etc.”

“What this indicates, amongst other things, is that fitment and component technology innovations and new material developments are set to continue in certain geographies as competition between different factory floors increases and the world slowly returns to a ‘new kind of normal’.”

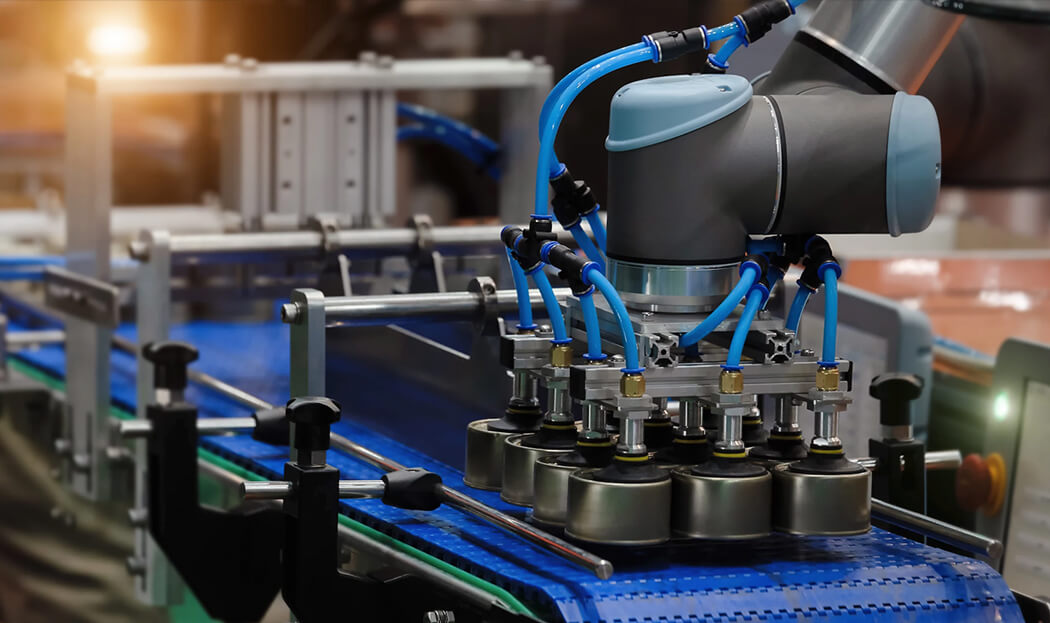

4. Packaging Automation vs Labour

What are the long-term impacts of ‘working from home’ and labour shortages on manufacturing and procurement?

“Even prior to the pandemic, packaging manufacturers and factories were experiencing a shortage of qualified workers. That shortage was compounded by a world uncertain of how to navigate a global health crisis and still maintain their operations,” says Faizal Kassim, Operations Director at IPL.

“Some companies are having trouble getting their employees back to work. Others are finding it hard to maintain social distancing on packaging lines. Still others are seeing demand skyrocket but not able to fill the positions needed to keep up with this demand.”

“We’re bound to see increased strides in packaging automation that will help to reduce reliance on the uncertainties of human labour and be ever more important during a global health crisis,” says Kassim.

“Several processes, particularly in the more luxury categories, however, will remain more dependent on labour and technical expertise. In auditing and developing supplier relationships in these sectors, there will therefore be increased emphasis in understanding how the supplier can maintain a stable workforce.”

© Boris Bobrov

“At the end of the day, there is no guarantee that digital technologies will destroy jobs, nor any certainty that these technologies will lead to more and better jobs. Suppliers face vital choices over what technology they develop and how it is used,” he states. “As packaging suppliers, we need to make sure we’re choosing the very best solutions for our client’s varied requirements, ensuring we’re hitting that ‘sweet spot’ that balances improved technologies with human creativity and craftsmanship – such vital components of the luxury market.”

5. Supply Chain Impact

Massive logistics challenges have forced brands to look at ‘nearshore’ procurement. Is this trend likely to continue or will we see a return to primarily Asian supply?

“Packaging companies, like all others, will continue to deal with the shifting landscape of the global pandemic and we shouldn’t expect a swift end to the supply chain crisis in 2022,” says Kassim. “The omicron variant is leading to more staff shortages as people take time off sick and suppliers navigate new restrictions. China’s zero-COVID strategy is likely to continue to disrupt both production and transportation of goods, possibly for the entire year.”

© Jaggaer

“This is forcing packaging companies to look for contingency plans and to better understand their supply chains and their vulnerabilities. This could accelerate existing trends such as “China Plus One” in the US, as companies seek to reduce reliance on any one country,” says Kassim.

“It may also mean a preference for domestic suppliers in some instances and in other instances it may require digital technology to build new supply chain capabilities,” he explains. “But, whilst these advances are growing more prevalent in the global supply chain, they’re still a long way off from becoming the standard.”

“The truth is, some materials are difficult to produce outside of China,” agrees Delahaye. “Ultimately, however, those packaging partners who have alternative supply sources closer to home (or options for dual source manufacturing) or with better transport options can also help close the gap of the unknown. This will help avoid the exact kind of production pitfalls we saw during the pandemic, such as natural disasters, port closures, scheduling issues or material shortages.”

6. Delivery Cost Pressure

Pre and post-Covid freight rates are acutely different today, where are they heading?

“It’s difficult to predict this. We know that before the pandemic, retailers and FMCG producers were already facing intense cost constraints that were squeezing margins. This was also impacting packaging design, with changes being implemented to try and optimise volume and efficiency – along with smaller packaging that was ready made for shelves and e-commerce,” states Odendaal.

“Near-term uncertainties that pose risks to business growth are likely to exacerbate these cost pressures. Pricing for materials and shipping may well still fluctuate weekly with the probability of sudden changes in market conditions and supply chain delays. The good news is that, with supply chain issues affecting many a brand’s balance sheet, senior brand management are now typically more engaged with these issues than ever before,” adds Kassim.

“This elevated level of interest can – and should – remain,” he states. “The pressures will be significant, however, as supply chain strategies will shift from ‘just-in-time’ (with an emphasis on cost and freight rate reduction), to forging more resilient supply chains able to withstand shocks and balance inventory costs.”

“Those who are agile will enjoy the greatest benefits in 2022. From suppliers to manufacturers to logistics and store managers, everyone in the supply chain must be connected and transparent in order to fully understand usage and inventory projection,” says Kassim. “This will assist brands and packaging suppliers in placing accurate orders well in advance and jumping on good pricing when the time is right.”

7. Design of the Times

Has the demand for luxury products waned post-pandemic – and are we looking at more minimised and discrete packaging as a result of this?

“Luxury brands have faced two years of tremendous shifts. However, we believe the industry is emerging from this crisis with more purpose and more dynamism than ever before,” comments Odendaal.

“The pandemic essentially gave luxury brands a new code of conduct that places renewed value on discretion and minimalism and values time and tradition in design,” he says.

© Luxury Watches USA

In 2020 the personal luxury goods industry – spanning anything from jewelry to high-end watches and expansive bags and accessories – was in a shambles. However, over recent months, consumers have staged a remarkable comeback in terms of spending. Despite the many hardships caused by the pandemic, it seems that the luxury sector will continue to remain strong and the consumer will still want to perceive that the extra cost spent on a luxury brand will be represented by a higher level of quality and/or craftsmanship. Secondary packaging will remain an essential part of the luxury cues even if the emphasis might change for some brands.

The luxury consumer mentality has certainly shifted though. In the new luxury landscape homes have become luxurious work and play sanctuaries – positioning tech brands and luxury home products for event great success. Consumers are also seeking more longevity in their purchases; they’re buying less fast fashion and looking more towards luxury and luxury that’s made locally.

“Throughout the pandemic there has been widespread emphasis on supporting local businesses and communities. The public also has a new appetite for uplifting stories, bolstered by our shared need for human connection,” says Odendaal. “Highlighting the ‘human side’ of a brand has never been more vital. Therefore putting a face on our products and packaging – literally and figuratively – is an extremely effective way to connect with consumers.”

“With time now considered more valuable than before, the focus will now be on creating ‘micro-engagement moments. Emphasis will be on more personal packaging and unboxing experiences and curated content that delivers the extreme value clients expect from a luxury brand,” he says. “Packaging design also, of course, needs to have a strong sustainability narrative built into its core.”

Conclusion

Saying COVID-19 has changed the way brands and their suppliers do business is more than an understatement. The true impact of COVID-19 on day-to-day operations will take a long time to tally, both financially and emotionally, regardless of the industry.

For the packaging industry, this impact will reveal itself in both the short-term and long-term. Shifting trends will be multi-faceted, but the most seismic changes in packaging will likely be seen in e-commerce, sustainability and supply chain shifts – and as consumer attitudes continue to shift on a scale never seen before.

The future does indeed look different, but the challenges have brought forth many positives. Success will lie in our ability to adapt and show resilience, mitigate supply chain inefficiencies, identify potential risks early and forge stronger relationships with clients and suppliers.

IPL Packaging is a global luxury packaging supplier with offices in the USA, Europe, Mexico, Asia and Africa. Approved manufacturing is available in several Asian countries, as well as sites in Eastern Europe. We create bespoke, tailored and exclusive packaging for any premium or luxury brand and lead the entire process, from conceptualisation and design to production and delivery.

For more information on packaging solutions or to gain insight into our latest packaging trends, follow us on LinkedIn, Facebook, YouTube or Pinterest. Keep an eye on our news section for insightful articles and innovative ideas around packaging materials, product development and design.

More articles

February 24, 2021

Giving it Gears: The art of steampunk

November 26, 2020

TULLIBARDINE 15YO – A Luxury Packaging Awards Finalist

November 18, 2021

Made For Generations

September 1, 2021

Part two: Ingredients for Creating Greater Brand Value through Packaging

February 1, 2021

Hidden elements that make a difference to packaging quality – Part 1

March 22, 2021

Millimetres matter when it comes to packaging design

October 5, 2020

Highland (Double) Gold for Tullibardine

November 8, 2021